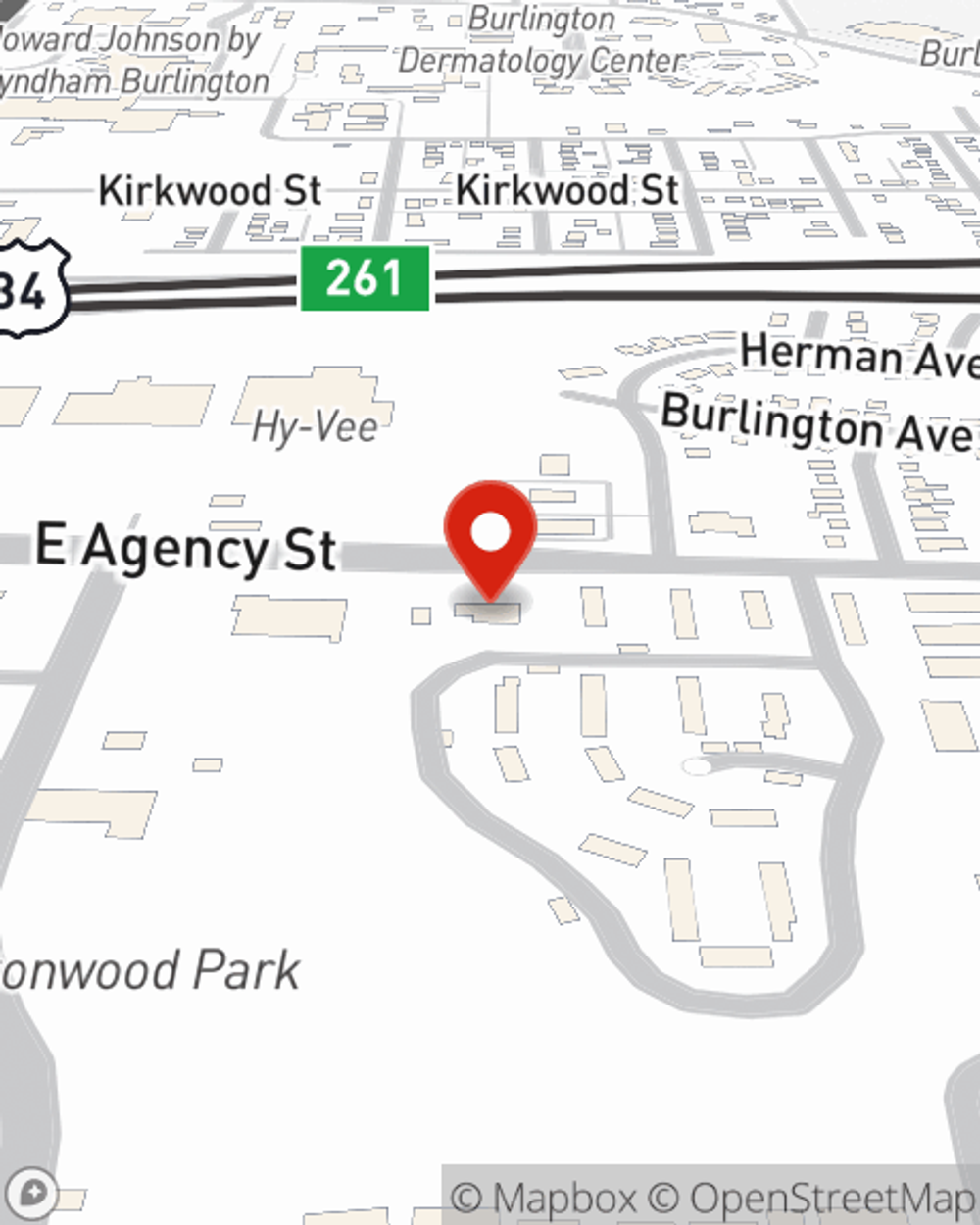

Business Insurance in and around Burlington

Searching for coverage for your business? Search no further than State Farm agent Ken Petersen!

Almost 100 years of helping small businesses

- Burlington

- Des Moines County

- Henry County

- Lee County

- Henderson County

- Danville

- Mediapolis

- West Burlington

- Gulfport

- Gladstone

- Carman

- Mount Pleasant

- New London

- Keokuk

- Wapello

- West Point

- Wever

- Iowa

- Illinois

- Southeast Iowa

Insure The Business You've Built.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all on your own. As someone who also runs a business, State Farm agent Ken Petersen knows what it's like to put in the work that it takes and would love to help lift some of the burden. This is protection you'll definitely want to consider.

Searching for coverage for your business? Search no further than State Farm agent Ken Petersen!

Almost 100 years of helping small businesses

Strictly Business With State Farm

For your small business, whether it's an advertising agency, a hobby shop, an acting school, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like business property, accounts receivable, and loss of income.

Call or email State Farm agent Ken Petersen today to discover how a State Farm small business policy can ease your worries about the future here in Burlington, IA.

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Ken Petersen

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.